Nowadays everybody and their grandmother says they want to invest in real estate. And why wouldn’t they? It’s a simple concept that has generated returns for countless people for hundreds of years. However, a simple concept does not mean a simple process. Especially when you aren’t familiar with real estate investing terms, concepts, and most importantly how the returns work.

It’s important to understand some fundamental concepts about real estate crowdfunding before we get to the returns.

What is Real Estate Crowdfunding?

Real estate crowdfunding is the process of raising capital from a pool of investors,online, for a real estate project. It’s a way for real estate entrepreneurs and teams to get the cash they need to renovate a building, flip a house, buy a property, or execute on any other type of real estate project.

On the other side of the equation, real estate crowdfunding provides any average person with the opportunity to invest their cash into the real estate market without financing and managing a project on their own.

Why consider Real Estate Crowdfunding?

- Diversification.

Whether you already have investments or are just starting, practicing diversification is a great way to reach your long-term financial goals while minimizing risks. Real estate is a popular alternative asset to stocks or crypto that can help round out a portfolio and hedge risk. - Hands-off investment.

Real Estate Crowdfunding is a great way to get exposure to real estate investing as a beginner. You do not have to search for property, get an acquisition or construction loan, manage or screen tenants or oversee maintenance and repairs. More importantly, in most cases, someone else is responsible for loans used for the project. Your obligations and involvement are minimized, yet the potential for profit still exists. - Accessibility.

You can invest in some Real Estate Crowdfunding projects for as little as $100. - Community Participation.

You are literally helping to build or renovate buildings that could be in your own neighborhood or city, alongside like-minded investors. - Hedge against inflation.

Real estate has sometimes offset inflation with it’s appreciation in value. A study utilizing NCRIEF national data over a 38-year period showed that property values of certain real estate sub sectors provide an almost complete inflationary hedge. When lease terms and debt are advantageously structured, the probability of real estate performing well during inflationary periods can be enhanced.

Who can invest in Real Estate Crowdfunding?

Anybody. There are limitations on how much you can invest when you are not an accredited investor.

There are several ways to qualify as an accredited investor. The most frequent qualifications are:

- A person with a net worth of at least $1 million; or

- A person with an annual income of $200,000 or $300,000 if filing jointly with a spouse

How Do Real Estate Crowdfunding Returns Work?

There are primarily two types of real estate crowdfunding returns - equity and debt. And there are a couple types of debt returns you may see in crowdfunding.

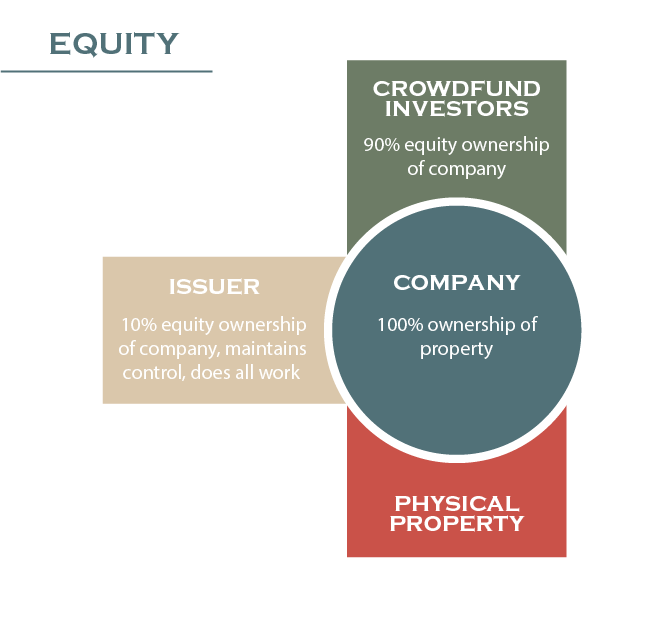

Equity, in real estate, is investing in a Company that owns property. You will receive shares or stock in exchange for your investment in the Company. See example diagram below to illustrate the structure.

In equity real estate investments, money is typically generated from rental income, appreciation, and profits generated from any business activities that depend on the real estate.

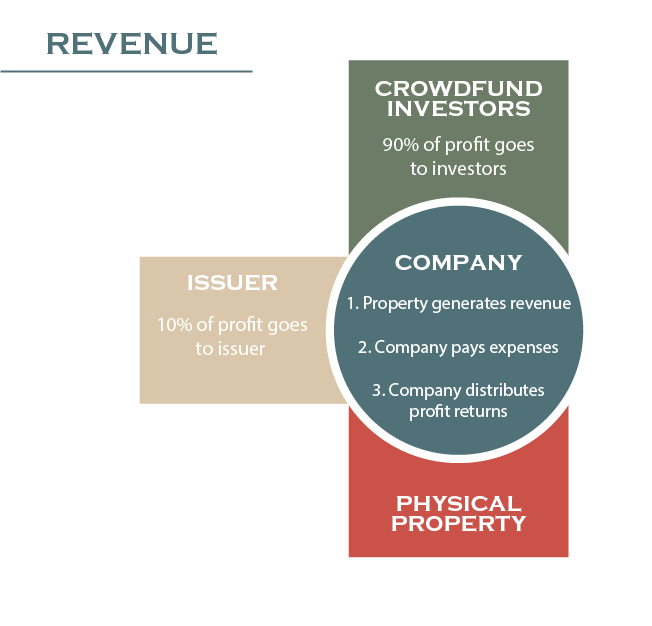

First the Company that owns the property generates revenue through rent and related fees. The Company then pays for operating expenses, amounts due on any loans borrowed by the Company, and puts cash aside for reserves. Then the remaining cash, typically quarterly, gets distributed amongst the equity partners (i.e. you). In some cases, publicly traded companies (i.e. on the stock market) will do this as well, this is frequently called a “dividend” but it is increasingly rare compared to real estate, where it is more common. See an example of the cash flow distributions below.

On top of cash flow distributions over time, the value of the real estate may increase - this is called appreciation. This means that whatever equity you own in the company can also increase in value. Unlike the stock market, investments in real estate are “illiquid” meaning it could be hard to sell your equity. However, the Company may sell the property or refinance the property, this is typically called a “capital event” and you may receive a special distribution as a result of a capital event. Even though there is no “ready market” for your shares or stock in the Company, you may be able to sell the shares or stock for a profit. So not only are you receiving cash flow distributions while you own shares or stock in the Company, but you also might profit by selling your equity or as a result of the Company’s capital event.

Debt is what most people are familiar with in real estate. This is a loan - think about a mortgage, except in this case, you are the bank.

An important date to understand for a loan is the maturity date. All loans have a maturity date. The maturity date is the deadline by which the principle of the loan must be paid back in full.

There are two primary types of debt, interest-only loans and amortizing loans.

“Interest-only” loans are just how they sound. The issuing Company will make interest payments (monthly, quarterly, or annually) to you at either a fixed or varying interest rate. These payments are typically JUST interest, and no principal. On the maturity date, the issuing Company will repay all of the principal balance of the loan. These types of loans are typically short-term in nature and common for acquisition and construction loans, key for real estate development projects.

“Amortizing” loans are the opposite, where the issuing company will make payments of both principal and interest, based on a fixed schedule, over the life of the loan. At the end of the amortization schedule the loan will be fully repaid, and no balloon repayment of principal will be due. This is similar to a residential mortgage. These types of loans are typically called “permanent loans” in real estate and are more frequent for properties that are already occupied.

Instead of a structure like in an equity offering, you will simply hold a debt note. A debt note is an agreement between you and the issuer. This agreement means that the issuer is planning to pay back the entire investment, plus additional money.

You are effectively loaning money to the issuer in hopes of getting all of your money back, and extra money in the form of interest. See example below.

Debt Offering Returns Example

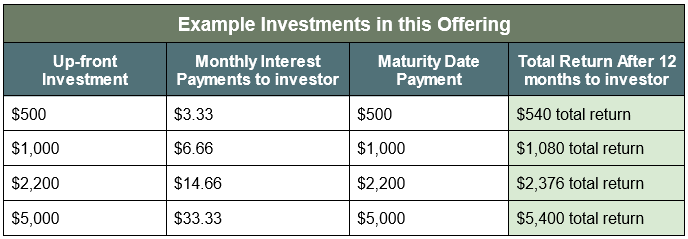

Issuer wants to fix and flip a house, so they post an interest-only debt offering on Common Owner asking for $100,000 of investment in debt notes with an 8% interest rate over 12 months. The maturity date on the loan is 12 months out. The issuer offers to make monthly payments of interest to all investors for 12 months. Interest payments for this offering would be calculated with this formula (X*8%)/12, where X is the investment amount.

By the time 12 months have passed, the issuer will have paid all investors the rest of their initial investment, plus an additional 8% with the proceeds. See table below for example investment returns for this offering.

So, if this offering were to be successful and the issuer delivers as planned, then the following would happen.

An investor that invested $1,000 would then receive $6.66 per month for 12 months. Then on the maturity date, the investor would receive a lump sum of $1,000. Their total return would be $1,080.

Investing in a real estate crowdfunding debt note offering is an excellent way to diversify your investment portfolio alongside stocks, crypto, and other investment types.

Investing, including real estate investing, involves a high degree of risk. A lot of smart people lost a lot of money in 2008-2009. Make sure to read all of the disclosures for any investment you are considering and never invest more than you can afford to lose.